August 2024

VOLUME XXXVIII, NUMBER 5

AUGUST 20234, VOLUME XXXVI, NUMBER 5

Minnesota health care roundtable

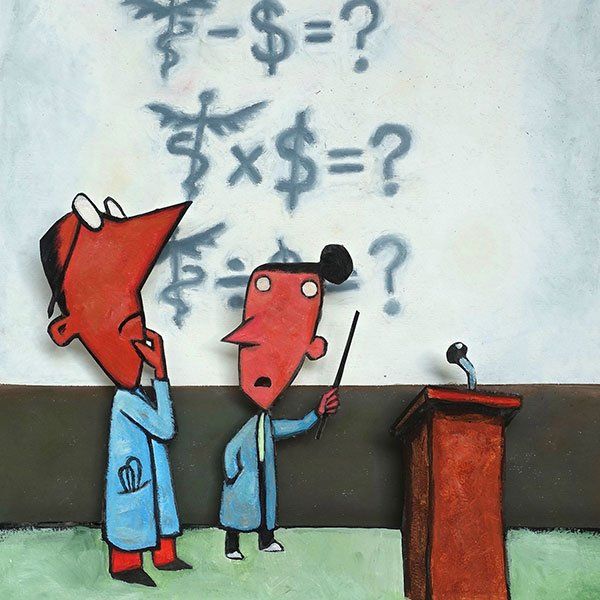

Health Care Reimbursement Transparency

Inside the black box

The following report from the 58th session of the Minnesota Health Care Roundtable focuses on the issue of transparency in reimbursement for medical care services. Our expert panel defines this term and explores many reasons why third-party payer reimbursement should be transparent and how its shifting-sand opacity needs to change. The panel offers diverse perspectives on how the lack of transparency affects important elements of our health care delivery system. We extend our special thanks to the participants and sponsors for their commitments of time and expertise in bringing you this report. This winter we will publish the 59th session of the Minnesota Health Care Roundtable, which will address the Inflation Reduction Act and conflicting perspectives on the solutions it brings to many problems facing health care delivery. As always, we welcome comments and suggestions.

the panelist

JESSE BETHEKE GOMEZ, MMA, is a member of the leadership team for Disability Hub MN and Executive Director of Metropolitan Center for Independent Living, a provider of comprehensive services assisting people with disabilities in the seven county Minneapolis–St. Paul area. He has worked in leadership roles in behavioral health care at CLUES, the American Red Cross and the United Way.

Kari Thurlow, is the president and CEO of LeadingAge Minnesota, a network of mission-driven organizations serving older adults in all the places they call home. They provide their 1,300 member organizations with advocacy, leadership, education and events, connections and support to assist providing older adults with the best possible care.

about the sponsors

LeadingAge Minnesota Foundation helps transform and enhance the experience of aging, build the workforce of tomorrow, advance new approaches to care delivery and develop leadership at all levels.

The Metropolitan Center for Independent Living (MCIL) empowers members of the disability community to overcome barriers and discover access, choices and the possibilities to realize their goals and aspirations.

PrairieCare is one of the nation’s largest providers of premium psychiatric services, providing individuals of all ages a full continuum of mental health care at convenient locations in the Twin Cities, Rochester and Mankato.

Transparency in health care services reimbursement to providers does not exist. Please define this term in a way that captures the wide spectrum of issues it includes.

Anish: Health care services reimbursement transparency refers to the disclosure of pricing information and payment rates for medical services, procedures and items, which can include a broad spectrum of issues — things such as negotiated rates between insurers and providers, the discrepancy between those rates and the actual amount paid by insurers to providers, not always the same amount, and also the out-of-pocket costs to patients. In maternity care, transparency would also cover how costs are divided between prenatal visits, labor and delivery, postpartum care and any complications that might arise. The lack of transparency has an impact on decisions made by both patients and providers, leading to confusion and potential financial strain, and affects the overall quality and accessibility of maternity care.

David: As it relates to health care, to date most efforts at cost transparency have focused on posting prices for hospital procedures. As of January 2021, federal legislation has required creation of this information for some 300 procedures. Requirements include posting at the in-network provider level and also explanation provisions for out of network providers. So far results and compliance are mixed. The intent is to assist consumers as they shop for optimizing the value of their benefit dollars. Presumably this will help consumers because they want to “Buy Right.”

Payment transparency that provides clarity in the process by which providers are paid includes several components. Among these are fee schedules, the basis of payer determination for services, procedures and treatments. Another element includes negotiated rates that are made between providers and payers. These include commercial insurers and government programs. Rarely, this can be a large self insured employer who contracts directly with providers. It is important for coverage policies to be transparent and to detail how the service as priced should be listed as covered on the payer’s schedule of benefits.

Another element that should be very clear for anyone to understand addresses billing methods. These include bill generation and itemization, and communication to patients and payers. Generally a key end result is The Explanation of Benefits document. Implicit in these data are payment timelines addressing the calendar milestones and the processes involved in distributing payments to providers. When cost sharing is involved, member liability or out-of-pocket exposure borne by the patient via deductibles, copays and coinsurance must be clear. Value-based payment must be clear, and this includes methods used to reward providers for achievement of certain cost and quality metrics, which the patient is entitled to know and understand.

Kari: Long-term care services and supports are financed through a variety of funding mechanisms, but by far the largest payer in our sector is Medicaid. Private insurance covers a relatively small portion of the services in this field. Medicare funds long-term care by covering nursing homes and home-based care for skilled needs, often after a hospital discharge, but not for ongoing help with activities of daily living.

While the payer mix is different in long-term care compared to acute or primary care, it seems that the definition for transparency is likely consistent. For our members, reimbursement transparency refers to the clear and open disclosure of payment rates, criteria and processes used by insurers and government programs to compensate long-term care providers for the services they deliver. Many of the processes used by managed care payers are not transparent and create excessive burdens on providers, which ultimately affects access to care for older adults.

For long-term care providers, transparency is crucial as it affects financial planning, resource allocation and ultimately the quality of care provided to residents. Without transparency, providers struggle to predict cash flows, to understand reimbursement discrepancies and to advocate effectively for fair compensation.

Significant transparency is already incorporated into laws and regulations that apply to long-term care providers. For example, Minnesota nursing homes cannot change rates to their residents without providing advance notice, which is a form of transparency lacking in many other areas of health care. Moreover, nursing homes are subject to rate equalization, meaning the private pay rate cannot exceed the Medicaid rate set by state lawmakers.

Minnesota assisted-living providers also are required in state law to provide information about the rates they charge and the services they offer, and they are required to notify residents of adjustments made and document that residents have received the information. They operate on a contractual basis with the residents they serve and therefore are very transparent about the services they provide and the costs of those services.

Jesse: Three areas of health care are converging right now at the policy level that drives the required work at the provider level. One is on health care transparency of costs, the second is on quality or productivity of health care and the third area is the combined role of reimbursement of insurance and government as payers. All three areas intersect in health care.

Holding payers accountable requires statutory language.

—Jesse Betheke Gomez

What elements of health care services reimbursement are most important to be made transparent?

Kari: or long-term care providers, the most critical elements of health care services reimbursement that need transparency are reimbursement rates, payment criteria and the billing process.

First, knowing the reimbursement rates for different services is essential. Providers need a clear understanding of what compensation to expect for specific treatments and care services to plan effectively and maintain financial stability.

Second, the criteria used to determine these rates must be transparent. This includes understanding how payers, including insurance companies and government programs, decide on the reimbursement amounts. Knowledge of these criteria can help providers align their services with reimbursable care, ensuring they can sustain operations while delivering necessary care.

Last, the billing process itself should be clear and straightforward. Transparency in the coding and documentation requirements can reduce administrative burdens and prevent billing errors that lead to claim denials or delays.

By addressing these elements, transparency in reimbursement will allow long-term care providers to manage resources more effectively, improve care quality and provide accurate cost information to residents and their families, enhancing trust and decision-making in care planning.

Jesse: While the Federal Transparency Rule, which began in July of 2022, requires that group health plans make certain information publicly available to better aid consumers in understanding how they will be charged for the health services they receive, Minnesota has advanced statutes on payment restructuring on quality incentive payments. Statute 62U.02 provides for the following: Effective July 1, 2016, the commissioner shall stratify quality measures by race, ethnicity, preferred language, and country of origin beginning with five measures, and stratifying additional measures to the extent resources are available. On or after January 1, 2018, the commissioner may require measures to be stratified by other sociodemographic factors or composite indices of multiple factors that according to reliable data are correlated with health disparities and have an impact on performance on quality or cost indicators.

For Minnesota, quality measures for people with disabilities need to be included as part of Minnesota’s commitment to health equity in order to advance transparency, address health disparities and have a positive impact on performance on quality and costs.

David: The most important payment elements have to do with a presentation format that is consumer friendly and explains the pricing along with benchmarks or best practices. Regretfully, this is very difficult to accomplish. Addressing cost elements is most important to make clear. This requires a cost analysis by service or procedure that reflects the providers’ internal overhead cost for delivery, not the price charged initially for this step. This analysis must relate to coverage information, such as details on which services are covered and at what rates.

Any out-of-pocket portions such as estimated member exposure must be clear. Disclosure of rates negotiated between payers and providers for selected, not all, procedures should be clearly available.

Payment policies and procedures, including explanation of timelines to anticipate for payment and how denials and appeals are to be handled should also be clear.

Anish: Maternity care includes a lot of variables. There’s a variety of services provided throughout a pregnancy, and sometimes emergencies arise that can’t be anticipated but still need to be factored into financial planning. It’s essential for an OB/GYN to have clear and detailed information about reimbursement rates for each of those services, including prenatal visits, labor and delivery (both vaginal and cesarean), postpartum care and emergency interventions, and understand how those rates vary by health insurer. But it’s not as simple as listing reimbursement for services — all physicians need clarity on the specific criteria and guidelines that determine reimbursement amounts, including any quality metrics or performance-based factors that influence payment. Are there financial incentives for meeting certain quality standards? How about penalties for not meeting them? And what happens if a physician performs additional nonstandard procedures or extends care?

Understanding the variability in payment rates between private insurers, Medicaid, Medicare and other government programs and the expected timelines for payment (including average payment delays and processes for addressing overdue payments) is important. And transparency is also necessary around guidelines on the processes for claim denials and appeals, including the reasons for denial, required documentation and resolution timelines. Any hidden costs, like administrative fees or charges, need to be clear line items, as they are ultimately going to affect the final reimbursement amount.

And patients need to be prepared for all of the contingencies and know what they are expected to pay out-of-pocket for different maternity services, including co-pays, deductibles and other charges, so that doctors can better manage their practices, provide high-quality care, and ensure fair compensation for their services, while helping patients understand their financial responsibilities and make more informed health care decisions.

THE SPONSORS

THE SPONSORS

What are the biggest reasons this level of reporting and accountability does not exist?

Jesse: There is an axiom “what gets measured gets done.” At the federal level people with disabilities for certain federal and state benefits and services have to meet a $2,000 asset limitation for individuals and $3,000 asset limitation for couples. These asset limitations of $2,000 and $3,000 were established at those same dollar amounts over 40 years ago, in 1983.

The biggest reason that the level of reporting on quality measures, and therefore costs measures of health care for people with disabilities, does not exist is that in Minnesota and in the United States, we need to elevate and include in our policy constructs services to people with disabilities.

How can the quality of care and therefore the quality of life of people with disabilities who rely upon certain federal and/or state services with a 40-year-old level of fixed asset limitations be anything but a concern for the well-being of people if people with disabilities are not specifically included in the recent movement to increase transparency in costs, quality and health outcomes.

David: Decades of frustration with hospital accounting systems have resulted in, at best, a poorly defined relationship between the hospital charge versus the cost the hospital bears in providing the service. Attempts have been made to use the Ratio of Cost to Charges (RCC) to solve this riddle, but that is not without controversy. RCCs are often used at the DRG level but this is still considered by some to be a blunt instrument. Accuracy is further debated, however, when attempts to use RCCs are made at the individual procedure level.

From the consumer perspective, the impact on out of pocket costs, because of the to still-to-be-applied deductibles, copays and coinsurance is unknown. There is a large potential impact when factoring in where along the journey the consumer is toward the yearly out of pocket maximum, ranging from larger member liability early in the benefit year to first dollar coverage, or no member liability, later in the year.

There can also be surprises, such as if a patient thinks a screening colonoscopy is done at no charge but when a polyp is found and snared there is a charge.

In general, there are four components to this lack of reporting and accountability. One is the complexity of the problem because price transparency involves a vast constellation of stakeholders, regulations and payment models.

Then there are issues related to confidentiality. Terms and conditions that forbid disclosure of negotiated rates are included in many contracts between payers and providers, particularly commercial payers. A lack of standardization among coding, billing and payment practices is another well-known source of variability. Finally, there is often an inherent aversion to change throughout the health care delivery system. Change management is a key work stream for facilitators involved in creating price transparency. Both payers and providers can see transparency activities as competitive threats as well as administrative burdens.

Anish: First, health care is extremely fragmented. We know this. Data are spread across hospitals, clinics, insurers and public health departments, and we haven’t figured out a way to share the data between stakeholders. Add to that the complexity and variability of reimbursement systems among different payers, including private insurers, Medicaid and Medicare, and standardization becomes nearly impossible. Each payer has its own set of rules, rates and administrative processes.

Second, insurance companies often operate with proprietary practices and confidentiality agreements that obscure payment details. This lack of transparency prevents physicians and other health care providers from fully understanding the reimbursement process and negotiating fair compensation. Again, we come back to the problem of standardization. There are no standardized reporting requirements across the health care industry, resulting in inconsistent and incomplete data collection and reporting.

There is also significant administrative burden and cost associated with collecting and reporting detailed reimbursement data. Staffing and labor shortages across the country are already taking valuable time away from patient care. Many physician practices, especially smaller ones, lack the resources to invest in the necessary infrastructure and personnel to manage these tasks effectively. Moreover, stakeholders who benefit from the current opaque system, such as certain insurers and intermediaries, resist changes that could disrupt their financial advantage.

Inconsistent regulations and enforcement at state and federal levels contribute to the lack of accountability. Without clear and uniform guidelines, it’s challenging to implement and maintain transparent practices. These regulatory inconsistencies also make it difficult for physicians to stay informed and compliant with varying requirements.

Kari: For long-term care providers, our biggest challenge is in ensuring transparency by managed care organizations and other health insurers, including Medicare Advantage plans. These entities have frequently sought to preserve their own specific approaches to prior authorization and assessing a client’s need for services. In addition, each of these organizations maintains its own billing practices.

These practices are not transparent to providers or consumers and create a heavy burden on providers to maintain approval, appeal denials and recover payment for needed services. This is one of the top complaints reported to us by our members.

We remain hopeful, as the federal government has been pursuing a new rule that is designed to bring more accountability and transparency to these practices, which should be of benefit to providers struggling with these challenges and to the clients they serve.

Creating meaningful transparency starts with better data analytics.

—David Plocher

What are the biggest benefits that could come from holding payers accountable for how they reimburse for health care services?

David: The main benefits are better management of consumer expectations and avoiding surprises. The informed consumer will be better equipped to shop for services and to manage their out of pocket expenses. Various transparency exercises can expose inefficiencies and show ways to reduce unnecessary costs, thereby promoting more cost effective care delivery. To the extent value-based payments are in place, one can expect the needle to move in the direction of superior outcome data. Also, exercises that build price transparency results can improve collaboration and trust between payers and providers.

Kari: Holding payers accountable for how they reimburse for health care services can bring significant benefits to long-term care providers.

First, accountability ensures fair and consistent reimbursement practices, which helps providers maintain financial stability. Knowing that payments will be fair and timely allows us to plan and allocate resources more effectively, ultimately leading to better care for our residents. Most long-term care providers are still recovering from financial devastation from the pandemic and workforce shortages. Many nursing homes are still operating with negative operating margins, and many assisted living settings are also still struggling to return to pre-pandemic margins. Under these conditions, long-term care providers need payers to be accountable to remain viable.

Second, it encourages transparency and clarity in reimbursement policies. When payers are held accountable, they are more likely to provide clear guidelines and criteria for reimbursement. This transparency reduces administrative burdens, minimizes billing errors and decreases the frequency of claim denials and delays, allowing us to focus more on patient care rather than paperwork. Because the long-term care sector is still experiencing a severe workforce shortage (we currently estimate that we have about 17,000 open positions in Minnesota), we cannot afford to deploy staff to address administrative inefficiencies due to a lack of transparency.

Third, accountability fosters trust between providers and payers. When reimbursement processes are transparent and fair, it builds a cooperative relationship, ensuring that providers feel supported in delivering high-quality care. This is critical as we move toward more value-based reimbursement in long-term care. For long-term care providers to engage in value-based reimbursement models, they must trust that payers will deliver if outcomes are met.

In essence, accountability in reimbursement practices leads to a more efficient, transparent and equitable healthcare system, benefiting providers and residents alike.

Jesse: Holding payers accountable requires statutory language that requires payers to understand the microeconomics of sustainability of care providers, their cost drivers along with quality and health outcomes. This becomes an issue of sustainability of our nation’s health care system as an ongoing national concern.

Anish: First and foremost, it would improve patient access to affordable maternity care by ensuring fair and consistent reimbursement rates for essential services. This would enable medical practices to provide comprehensive care without worrying about finances and pave the way for more equitable care delivery. Enhanced transparency and accountability would also foster greater trust and satisfaction among patients and physicians, which has been shown to translate to better health outcomes. Patients are much more likely to follow a care plan if they aren’t skeptical about hidden costs and financial surprises.

Clear and consistent reimbursement guidelines would streamline the billing process, reducing the time and resources spent on navigating complex payment systems and resolving payment disputes. This efficiency would free up doctors to devote more time to direct patient care.

The argument for value-based reimbursement models is not a new one. Aligning payment incentives with quality care outcomes would encourage physicians to adopt best practices and innovative approaches that enhance patient health, unlike current fee-for-service models that perversely incentivize volume of services provided over quality of care.

Finally, holding payers accountable would enhance the ability to identify and address fraud and abuse in the reimbursement system. Transparent practices would make it easier to detect discrepancies and take corrective actions, ensuring that resources are used effectively and ethically.

Inequitable care starts with disparities in payment.

—Anish Sebastian

What should change about state/federal government reimbursement for health care services?

Anish: State and federal government reimbursement for health care services has to be competitive with the market. Serving the Medicaid/Medicare population should not have to come at financial risk for a doctor or practice — it’s not sustainable, and it directly contributes to health inequities. Under the current system, underserved areas — especially rural areas — are losing maternity care providers. Younger OB/GYNs are gravitating toward higher-income practices that have fewer deliveries. According to one study, about one-third of ACOG members are dealing with inequitable government reimbursement by refusing to accept patients with Medicaid as their primary insurance.

If this sounds like a broken record, it’s because this one of the most important points to hit home — standardization of reimbursement rates and criteria across different states and government programs is essential. Consistent payment rates would ensure that physicians are fairly compensated regardless of their location or the specific government program they are working with. This standardization would also make it easier for medical practices to navigate the reimbursement landscape and focus on providing care rather than dealing with complex payment systems. Streamlining the processes for submitting claims, handling denials and appealing decisions would reduce the administrative burden on medical practices, allowing them to allocate more resources to patient care.

In addition, state and federal governments need to provide better support and resources for OB/GYNs dealing with high-risk pregnancies and complications. Special reimbursement rates or incentive programs for handling complex cases would ensure that these providers are adequately compensated for the additional time, expertise and resources required.

In the maternal health field specifically, the federal government is moving toward better practices, proposing initiatives that will reward state Medicaid agencies for maternal health improvements such as better reporting strategies, expanded definitions of risk and funding for services outside the traditional scope of pregnancy care, such as doulas and mental health care. We need to see more of these kinds of incentives.

Jesse: e need to look seriously at the cost, quality and payment of catastrophic care and assess how best to address these issues as a national ongoing concern. We must position catastrophic care costs, as well as report on its quality and outcomes, as fundamental ongoing concerns of the United States federal government. Lowering catastrophic care costs while improving its quality and outcomes will be of great benefit to our entire health care delivery system.

David: There actually is upward pressure on state/federal payment levels. For example, at the DRG level in Medicaid and Medicare, there is often a negative contribution margin at current payment rates. This has contributed to the closure of many rural hospitals. To better address this, government payers need to achieve a level of standardized reporting that allows benchmarking and trending. Especially with the recent trends to value-based payment, government payers need to adopt these contracting features more widely. They need to allow the public to see related information pertaining to rates, payment policies and performance metrics..

Kari:

This is difficult to answer for long-term care, as each service model has a different methodology for reimbursement. In general, reimbursement processes should be simpler and more understandable for consumers and providers. Equally important is that state and federal lawmakers should more fully fund the costs of long-term care in reimbursement rates. Medicaid reimbursement rates fall below the actual cost of care, and lawmakers should be more transparent as this often results in cost-shifting to private pay clients. .

THE SPONSORS

THE SPONSORS

What should change about health insurance company reimbursement for health care services?

Kari: These payments need to be clearer both in terms of the amount to be paid and what it covers, with an easier process to continue authorizing services when they are needed on an ongoing basis. The federal rule on managed care is, we hope, a step in the right direction here, but vigilance will be needed to see how it is working, and we must continue to push for modifications that serve the interests of better experiences and outcomes for clients.

Jesse: When I served on the Minnesota Citizens Health Care Costs Review Panel in the early 2000s, we looked at recommending fundamental change in the scope of risk pools that otherwise were micro-focused on employers. Where Minnesota made gains from our work back then was to shape how we expanded risk pools that better served the needs for the common good and greater good of all in Minnesota and drove down costs. Twenty years later, looking back, we see that more needs to be done.

David: Major changes in commercial health insurance payment are not critical. There is, however, always room for improvement. Perhaps most notably is improved clarity around what is covered and policy holder access. More detail around pricing would be helpful, such as requiring payers to disclose negotiated rates and risk-sharing terms. It would also be helpful to require payers to disclose incentives borne by providers involving quality metrics and cost of care.

Anish: Three things come to mind, standardization, simplification and transparency.

Insurers should disclose how they determine premiums, deductibles, and reimbursement rates, allowing physicians and patients to understand the financial aspects of their health care. This transparency would foster trust and enable better financial planning for both providers and patients.

Again, if we care about addressing the U.S. maternal mortality rate, health insurers need to prioritize value-based care. They need to move away from fee-for-service models that incentivize volume over quality and instead adopt payment models that reward OB/GYNs for achieving positive health outcomes for mothers and infants. Such models would encourage best practices and innovative approaches to maternal care, ultimately improving patient health.

In addition to changing the methodology for reimbursement — what is being reimbursed — it’s essential that we implement better regulatory oversight to ensure fair and equitable reimbursement practices. Regulatory bodies should enforce guidelines that protect physicians from unfair reimbursement practices and ensure that insurers adhere to transparent and standardized payment processes. This oversight would provide a level playing field and prevent discriminatory practices that may disadvantage certain providers or patients.

Insurers should also provide timely and accurate reimbursement. Delays in payment can create financial strain for medical practices, particularly smaller ones, which are closing their doors in underserved areas at alarming rates. Establishing clear timelines for processing claims and ensuring prompt payment would help maintain the financial health of medical practices and allow them to focus on patient care, and keep the lights on.

Knowing the reimbursement rates for different services is essential.

—Kari Thurlow

What are some of the problems that arise from reimbursing health care professionals different amounts for providing the exact same level of care?

David:

The main problem is such transparency can result in higher total cost of care as providers charging less can now see how much they can raise their rates to simply become even with their competitors and the benchmarks. Examples of these problems start with inequity. If providers see themselves not getting equal pay for equal work, the level of provider dissatisfaction could lead to disparities in care delivery. This could lead to provider disputes, which could escalate into larger conflicts impacting referrals, collaboration and care coordination. However these problems are addressed, they must be done in a way that minimizes patient confusion. The suspicious patient may give up on the delivery system when presented with contradictory price information.

Anish: Inequitable care starts with disparities in payment. Doctors, reasonably, are generally going to work where they can earn the best compensation. Unequal reimbursement practices lead to imbalance in provision of care and necessarily to poorer outcomes — and that typically hits underserved populations the hardest. Physicians who are reimbursed less may be less willing to accept certain insurance plans, particularly those that offer lower payments, such as Medicaid. Doctors that are reimbursed at lower rates have fewer resources to invest in their practices, which can lead to reduced availability of advanced technologies, lower staff levels and less time spent with each patient, ultimately compromising the quality of care and exacerbating health disparities among different socioeconomic groups.

Such discrepancies are guaranteed to cause dissatisfaction and burnout among physicians. Perceived unfairness in compensation can lead to frustration and demotivation, particularly when physicians feel that their hard work and expertise are not being adequately recognized. This dissatisfaction can result in higher turnover rates, reducing continuity of care for patients and contributing to historically high workforce shortages.

Disparities in payment also open up the potential for abuses such as discrimination and incentivizes unnecessary care or coding. Providers might try to compensate for lower reimbursements by increasing the volume of services provided, which can lead to unnecessary procedures and higher overall costs without improving patient outcomes. This practice not only burdens the health care system but also exposes patients to potential risks from unnecessary interventions.

Kari: We saw this situation play out for nursing homes in the early 2000s. Rural nursing homes were reimbursed at significantly lower rates than metro nursing homes. Over that period of time, we saw disparities grow in terms of financial health of the organizations, and that disparity impacted the wages they were able to pay caregivers and the quality care provided to residents. We sought to remedy this situation in 2015 by implementing a new cost-based reimbursement system, so while reimbursement amounts might be different, cost coverage was equitable. We saw wages for caregivers improve throughout the state and saw improved financial stability until the COVID-19 pandemic.

Please discuss the problems caused by inequitable and nontransparent reimbursement between government and private payers.

Kari: LTC providers who experience frustration working with certain health insurers may choose to avoid working with them, which limits the options for clients who need LTC services. Ultimately, this can create a barrier to accessing needed long-term care services and supports.

In the case of government reimbursement, if long-term care providers find that reimbursement for Medicaid or other government programs are inadequate and lacking transparency, they may choose not to participate in those programs or may limit the number of clients they will serve on these programs. This creates new equity concerns, as low-income seniors may find it difficult to find providers in their communities.

David: The consumer loses by not knowing what to expect and having to endure financial surprises in their Explanation of Benefits documents. In terms of government versus private payers, the consumer will see lower rates for government payers, but that is not necessarily disruptive.

Problems arise related to provider disparities that may lead some providers to withdraw from participation in underserved regions. Even absent payment disparities, if payment levels are not covering the providers’ cost to deliver the service, lapses in network coverage will occur. To the extent there are differences between government and commercial payers, such basic features as report formats will be top of the agenda for the providers’ next transparency meeting.

Anish: The lack of transparency in reimbursement policies prevents physicians from making informed decisions about their practice operations and patient care. Without clear information on how payments are determined and what criteria are used, providers struggle to manage their finances and plan for future investments. This uncertainty can affect their ability to offer comprehensive care and invest in necessary technologies and staff. Plus, nontransparent reimbursement practices add complexity to billing and claims processes. Physicians must navigate different payment structures and administrative requirements from various payers, which increases the risk of billing errors and delays. This complexity requires additional administrative work, diverting more time and resources away from patient care and increasing operational costs.

The biggest losers in this situation are patients. When doctors receive lower payments from government programs it may limit their participation in these programs, reducing access to care for patients covered by Medicaid or similar programs. This can exacerbate disparities in health care, particularly for underserved populations who rely on government insurance. Sometimes it can even force the closure of hospitals or services that serve as a literal lifeline to a region. The lack of transparency also makes it tremendously difficult for patients to plan for health care events — in maternity care, this is a reality that likely contributes to declining U.S. birth rates.

THE SPONSORS

THE SPONSORS

Medication costs and access are significant issues in health care delivery. How could transparency around payment for medications improve those issues?

David: The consumer has much to gain from simple educational materials explaining the formulary tiers, allowing them to match their preferred medicines with the most advantageous tier. An added consideration would be to allow patients and providers the ability to compare drug prices across payers/PBMs and pharmacies. It would also be a benefit for regulators and legislators to allow payers to negotiate drug prices with pharmaceutical manufacturers at a macro level, thus allowing Medicare to speak with one national voice.

Jesse: We have recently learned from the initial work by the Biden administration that certain costs to produce certain medications are far below their current pricing. Transparency needs to go farther upstream and start with transparency on the cost to produce medications by the pharmaceutical industrial sector.

We live in a world today where we can find for literally every product in a grocery the price per ounce or pound. How is it that today the average person cannot have available and does not know the cost of what it took to produce the medication they are prescribed?

The real question here is do we have the courage and fortitude as a democracy to place the greater, common good as the standard for private industry. Why isn’t private industry accountable for things like medication cost transparency or insurance payment transparency to hospitals, physicians and other providers when the federal government requires hospitals to provide public information about the prices they charge?

Anish: As soon as you make drug costs publically available, you empower patients to make informed, cost-effective choices about payers and pharmacies. That’s naturally going to lead to more competitive rates and potentially lower costs. When physicians have access to transparent pricing information, they can make more informed prescribing decisions based on the cost-effectiveness of medications, selecting affordable alternatives or generics, helping to manage costs while still providing effective care.

Transparent payment information can also mobilize policymakers and advocacy groups. They can identify pricing trends and address issues related to high medication costs. With accurate data, they can push for policy changes that promote fair pricing and improved access to essential medications.

Kari: Pharmacy is a big challenge for long-term care providers. Sometimes providers have to pay these costs themselves or otherwise arrange for drugs to be available from a pharmacy that works with the specific coverage for different clients. Nontransparent and varying payment rates may or may not cover their costs and providers ultimately are not made whole. Efforts to make the rates more consistent across health care plans would be helpful for both LTC providers and the clients they serve.

Please discuss how reimbursement transparency in health care services could be regulated and enforced.

Anish: Agencies like the Centers for Medicare & Medicaid Services (CMS) and state health departments need to set clear rules for how reimbursements are handled. This means having specific guidelines for payment rates, billing processes and what’s covered in maternal care. Insurers and government payers should be required to provide detailed reports on these rates and coverage, which should be easily accessible and clearly broken down for services provided.

Creating online tools where both providers and patients can check reimbursement rates and coverage details would make this information more accessible. Regular checks and audits are also necessary to make sure that everyone is following the rules. If a payer doesn’t comply, there should be penalties such as fines or required corrective actions. Publicly sharing reimbursement data and practices can keep payers accountable and help everyone involved understand what to expect.

Encouraging cooperation between insurers, health care providers and patient groups can help develop and refine these transparency measures. Providing support and training for physicians and other health care professionals is also important to help them adapt to new rules and use transparency tools effectively. Highlighting successful examples of transparency can guide others in adopting best practices.

Kari: While far from an ideal model, LTC providers, particularly nursing homes, are subject to many regulatory requirements, including those covering notice of rate changes and notice of what is included in the rate and what can be billed separately. If other providers were subject to a form of these requirements it would be a move in the direction of eliminating lack of transparency and other issues around unexpected bills.

For government payers, lawmakers should work toward transparency in whether reimbursement rates are covering the actual cost of care. This would help inform taxpayers and privately paying residents of potential cost-shifting.

David: Beyond conventional audits, highly specialized transparency vendors, such as Turquoise, appear to have an emerging role with such regulations.

Recently, Turquoise appeared in press releases letting us know how our Minnesota hospitals performed. The combined ranking selected hospitals with a Leapfrog “A” patient safety rating and the highest price transparency rating from Turquoise Health and they are :

a. Abbott Northwestern Hospital (Minneapolis)

b. Mayo Clinic Health System (Austin)

c. Mayo Clinic Health System (Fairmont)

d. Mayo Clinic Health System (Mankato)

e. Mayo Clinic Hospital (Rochester)

In more general terms, payment transparency regulation and enforcement would include legislative mandates, which are powerful motivators for payers and providers. It would also include data and reporting standardization. Key to administrative simplification, reporting overhead reduction is the ability to compare/benchmark/trend reported data. Audits would be necessary to ensure reporting compliance and set up corrective action plans for noncompliance. These reports must be made public and be visible to all stakeholders to promote accountability.

Are there any other elements of reimbursement transparency in health care services you would like to discuss?

David: Only to comment on progress to date. While the majority of hospitals are in partial compliance with the transparency regulations, only 472 hospitals across 42 states are in full compliance, which represents a tiny fraction of the nation’s non-VA hospitals.

And even Turquoise may have room for improvement toward making the consumer interface friendlier and more practical. Case in point: one of the services on the Turquoise site is “Medical back problems,” a nearly hopelessly heterogeneous category that defies benchmarking.

In summary, creating meaningful transparency starts with better data analytics. The typical health system will need to ramp up in-house skills in medical informatics. It will include patient education. The typical health system will need to invest in patient education techniques around price transparency. Finally, the typical health system will need to participate in a forum inclusive of other stakeholders to make progress in price transparency.

Jesse: Long-term services and supports for the home care sector, at every level from federal to state to county, are significantly under funded. We need more legislative initiatives at both the federal level and the state level that call for showing the costs of service delivery, as well as competitive workforce factors, or component values for homecare positions such as personal care assistants, and direct support professionals. Why this is needed is that PCA reimbursement rates need to be sustainable for PCA agency providers, and at the same time, the more we can identify competitive workforce factors that are also part of the statutory reimbursement structure, the more we can stabilize the home care sector. For people with disabilities and older adults, our homecare delivery system is at great risk because of the need for more statutory requirements in which reimbursement rates are based upon known delivery costs and competitive workforce factors.

THE SPONSORS

THE SPONSORS

the panelists

JESSE BETHEKE GOMEZ, MMA, is a member of the leadership team for Disability Hub MN and Executive Director of Metropolitan Center for Independent Living, a provider of comprehensive services assisting people with disabilities in the seven county Minneapolis–St. Paul area. He has worked in leadership roles in behavioral health care at CLUES, the American Red Cross and the United Way.

David Plocher, MD, is an independent consultant and former health plan executive. He has served heath systems working in strategy, operations, informatics and medical management.

Anish Sebastian, is the CEO of Babyscripts. The company offers a maternity care program that enhances and extends the reach of clinicians and payers through remote tools to drive better risk management and effective interventions while strengthening the patient’s relationship with their care team.

Kari Thurlow, is the president and CEO of LeadingAge Minnesota, a network of mission-driven organizations serving older adults in all the places they call home. They provide their 1,300 member organizations with advocacy, leadership, education and events, connections and support to assist providing older adults with the best possible care.

About the sponsors

LeadingAge Minnesota Foundation helps transform and enhance the experience of aging, build the workforce of tomorrow, advance new approaches to care delivery and develop leadership at all levels.

The Metropolitan Center for Independent Living (MCIL) empowers members of the disability community to overcome barriers and discover access, choices and the possibilities to realize their goals and aspirations.

PrairieCare is one of the nation’s largest providers of premium psychiatric services, providing individuals of all ages a full continuum of mental health care at convenient locations in the Twin Cities, Rochester and Mankato.

MORE STORIES IN THIS ISSUE

cover story one

Assessing and Advancing Community Health: The overarching value of equity

By Brooke Cunningham, MD, PhD

cover story two

Generation Alpha and Skincare: Health care impact of a new craze

By Sheilagh Maguiness, MD

capsules

Top news, physician appointments and recognitions

Interview

A New Name for an Unchanged Mission

Rachael Perlinger is president of Healthcare Leaders Association of Minnesota and clinic administrator at Northland Plastic Surgery in Duluth

Health Care Roundtable

Health Care Reimbursement Transparency: Inside the black box

AUGUST 2024

cover story

Assessing and Advancing Community Health: The overarching value of equity

BY Brooke Cunningham, MD, PhD

CONTACT

(612) 728-8600 | comments@mppub.com

758 Riverview Ave | St. Paul MN 55107

© Minnesota Physician Publishing · All Rights Reserved. 2023

quick links

We welcome the submission of manuscripts and letters for possible publication. All views and opinions expressed by authors of published articles are solely those of the authors and do not necessarily express those of Minnesota Physician Publishing Inc., or this publication. The contents herein are believed to be accurate but are not intended to replace medical, legal, tax, business or other professional advice or counsel. No part of this publication may be reprinted or reproduced without written permission from our publisher.